UMC mortgage investments are first mortgage loans made to commercial borrowers to finance the purchase, renovation, or construction of commercial properties.

Here are some examples of projects financed:

Borrowers choose UMC over banks, credit unions, and other private lenders due to the high level of service, faster approval process, and reasonable interest rates. Investors in the UMC Mutual Fund Trust enjoy holding a diversified mortgage portfolio that has funded many different projects with a variety of borrowers in diverse locations.

| Fund Type | Open-ended pooled mortgage fund |

| Date of Inception | December 5, 2012 |

| Assets Under Management (AUM)1 | $240,854,233.90 |

| Eligibility | Non-registered, RRSP, RRIF, TFSA |

| Unit Value | $1.00 |

| Minimum Investment | No Minimum Investment |

| Redemption restrictions | None2 |

| Distribution frequency | Monthly |

| Management Fee | 0.60% of AUM per year |

| Number of mortgages | 47 |

| Priority of security | First position |

| Average term to maturity | 4 months |

| Average loan-to-value (LTV) | 75% |

1 – As of December 31, 2023.

2 – Units may be redeemed at any time; however, payment in cash may be delayed subject to cash availability.

PORTFOLIO METRICS3

Number of Investments – 42

Assets Under Management – $240,854,233.90

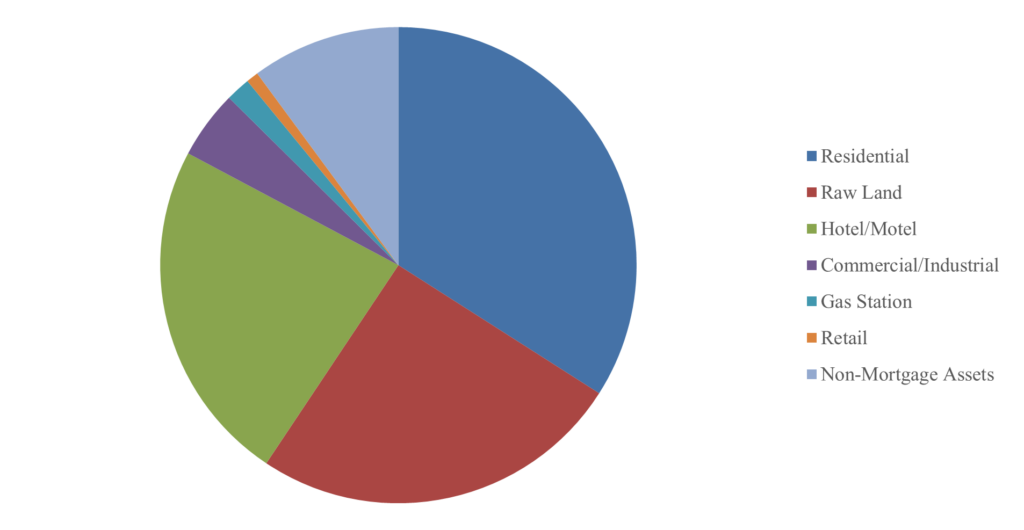

| Project Type | % Total Assets |

| Residential | 34.04% |

| Hotel/Motel | 25.31% |

| Raw Land | 23.42% |

| Commercial/Industrial | 4.63% |

| Gas Station | 1.66% |

| Retail | 0.83% |

| Non-Mortgage Assets | 10.11% |

| Total | 100.00% |

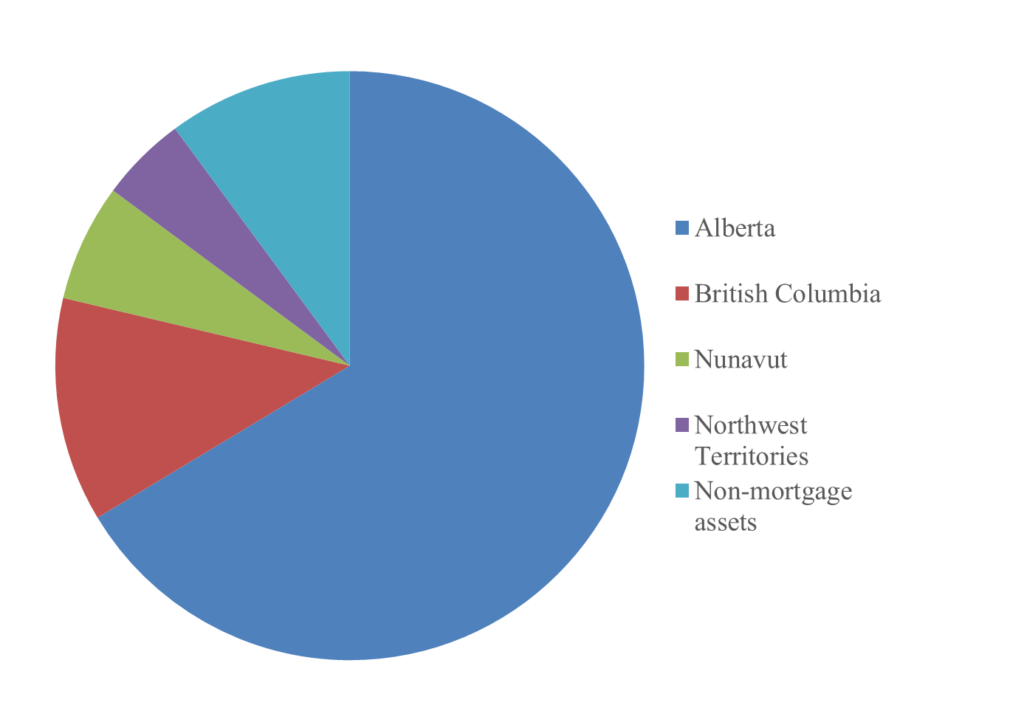

| Location by Province | % Total Assets |

| Alberta | 66.37% |

| Nunavut | 12.33% |

| British Columbia | 6.44% |

| Northwest Territories | 4.75% |

| Non-Mortgage Assets | 10.11% |

| Total | 100.00% |

More information about how to invest in the UMC Mutual Fund Trust:

Units of the Trust may be purchased through a registered Investment Advisor from UMC Financial. To purchase units, please contact Clement Lavoie: